Do you long for a life that isn’t financially dependent on others? Do you want to take your finances to the next level of security and freedom?

If so, this blog is for you.

Today at RaiseUp Families, we’ll discuss how, after achieving financial stability, you can continue growing financially toward a place of greater security and less stress.

Let’s take a closer look!

Before discussing financial self-sufficiency (sometimes called financial independence) and how to achieve it, we need to define it. For better or worse, the definition is somewhat subjective. Some define self-sufficiency as the ability to live without needing to work an active job. Others say you’ve achieved it when you can save 50% of your income.

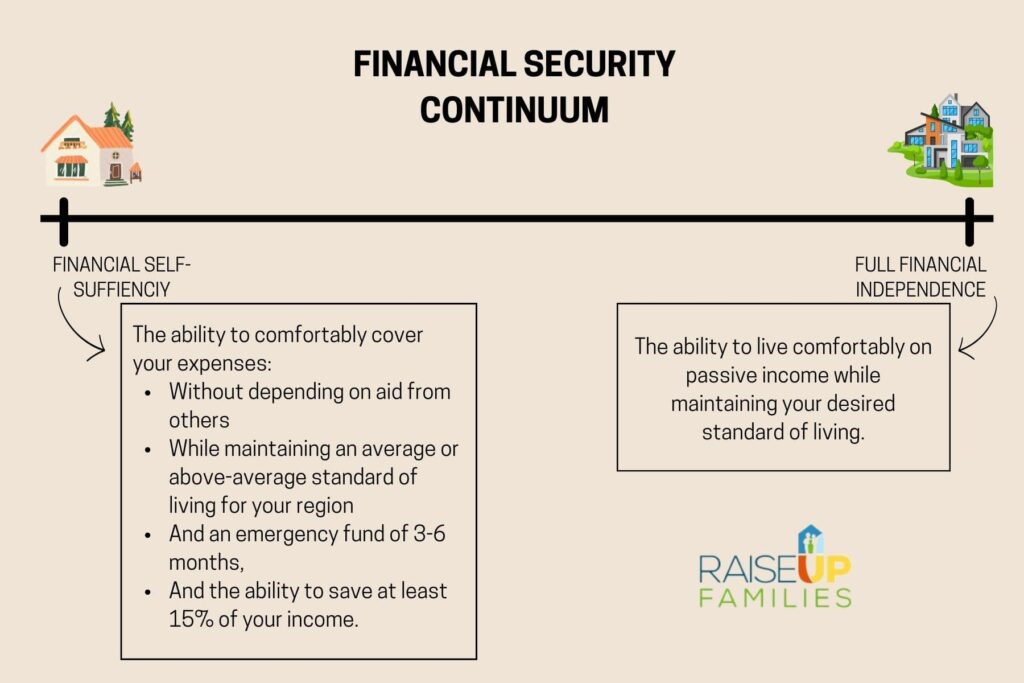

Think of financial security as a continuum with self-sufficiency on one end and full independence on the other. Here’s how we’ll define these key terms for this blog.

Point A–Financial Self-Sufficiency: The ability to comfortably cover your expenses

Point B–Full Financial Independence: The ability to live comfortably on passive income while maintaining your desired standard of living.

As you can see, these definitions are subjective. Financial independence looks different for people depending on where they fall on the continuum, where they live, and what their goals are. Our goal for this blog is to help you get on that continuum.

Let’s address the difference between financial stability and self-sufficiency. Before pursuing self-sufficiency, you’ll need to achieve financial stability. If you’re struggling to cover your living expenses, living paycheck to paycheck, or carrying a burden of debt, achieving financial stability should be your first goal.

If this describes your situation, we recommend reading our blog post, Achieving Financial Stability: A Guide for Families and Communities. It’s a great resource to help you create a plan and move toward the financial safety you desire. After you’ve achieved stability, come back and read this guide to continue your financial journey!

The first step in making a plan toward financial independence is identifying what's holding you back. Many things can hold us back from the economic future we desire. Here are a few:

Some of these barriers aren’t within your control, which can be really frustrating. However, take heart! You can do a lot to take more control of your situation and move toward self-sufficiency.

Ask yourself:

Now, let’s turn this to positive planning. Start by asking yourself this all-important question: “Why do I want to attain self-sufficiency?” Identifying your why helps determine your goals and is a source of strength for the tough times.

A good plan will include at least three components:

Now, let’s be real for a minute.

A plan can take time to create. Life circumstances or the rising cost of food and goods may disrupt it, and it will sometimes need adjustment. Just remember, this is part of the challenge. Work hard, and don’t forget to be kind to yourself. Try not to get discouraged when you experience a setback. Reflect on what went well and what happened, and make adjustments in your next attempt. Just don’t give up!

One of the best ways to move toward financial self-sufficiency is to diversify your income. As one old proverb says, “Don’t put all your eggs in one basket.” This is an excellent opportunity to get creative! Here are a few questions to help you consider how you might diversify your income.

Some examples include investing in stocks, business, or real estate, renting a spare room, selling designs, or even doing flexible jobs like DoorDash or Uber on the weekends.

You won’t be financially self-sufficient unless you have significant savings. Exactly how much savings you should maintain will vary depending on your area's cost of living. However, experts recommend saving 15% of your income and maintaining an emergency fund that could support you for at least 3-6 months in case of emergency. Of course, you can always save more if you’re able, but remember to keep your saving goals sustainable and within reach so you can meet them consistently.

When times are tough, you may have accumulated some credit card debt or been forced to skip payment due to lack of funds. This can be hard on your credit score. If this is your situation, here are a few tips for raising your score.

Our last tip is to invest wisely. Investing is always somewhat risky, but don’t choose high-risk investments, especially when you’re starting out or investing a significant amount.

It’s also essential to invest in yourself. Consider if further education or skills training would benefit you. Invest in your mental and physical health. If you aren’t doing well, you won’t have the energy it takes to achieve financial self-sufficiency.

Use a reward system where you reward yourself with something small when you hit a milestone. This could be something as simple as a nap or sharing a meal with a friend.

It's true.

Becoming self-sufficient takes a lot of hard work, planning, and self-denial. But it's worth the effort when you can say goodbye to financial stress and hello to the lifestyle you desire. We hope you found this blog to be a helpful guide on your journey!

If you are a parent of school-aged children living in the Houston area and are facing financial insecurity, RaiseUp Families is here to help!

Since 1994, RaiseUp Families has supported parents with school-age children by offering parents financial help while guiding them along the path to self-sufficiency. We teach essential budgeting skills, empowering parents to achieve financial independence and avoid relying on social services. Through personalized care, we provide training and confidence, enabling parents to build a brighter future for their children.

RaiseUp Families stabilizes families in vulnerable communities during financial crises, allowing children to concentrate on their education for a more promising life. Thanks to our efforts, families throughout Greater Houston are secure, and their children are thriving academically.

If you have any questions or want to see if you qualify for our program, please reach out! Also, be sure to check out the free resources on our website!

Here’s to a self-sufficient financial future!